- +92 333 1127836

- info@companyregistration.com.pk

- Karachi | Lahore | Islamabad

Filers and Non-Filers in Pakistan: A Guide to Tax Compliance

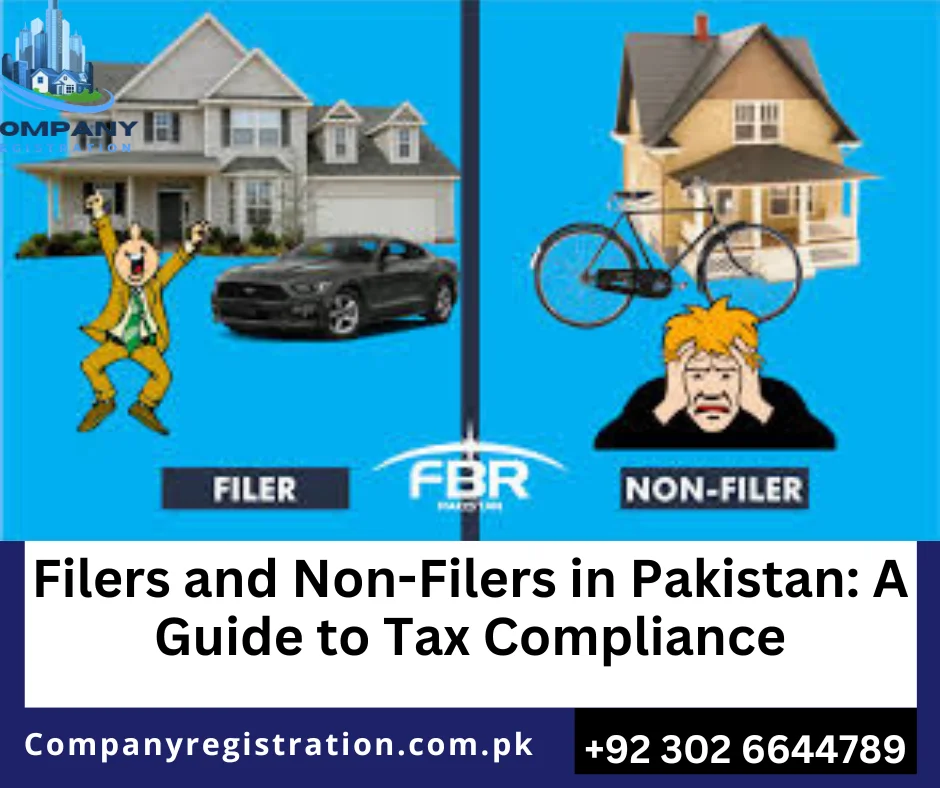

In Pakistan, the terms “filer” and “non-filer” carry significant weight, influencing the financial landscape for individuals and businesses alike. These classifications, established by the Federal Board of Revenue (FBR), dictate tax obligations and access to various economic privileges. This article aims to provide a thorough understanding of the distinctions between filers and non-filers, emphasizing the substantial benefits of being a filer and the repercussions of remaining a non-filer.

Who is a Filer in Pakistan?

A filer is defined as an individual or entity that appears on the FBR’s Active Taxpayer List (ATL) due to the timely filing of income tax returns. By fulfilling their tax obligations, filers demonstrate compliance with the country’s tax regulations, which not only reflects good citizenship but also unlocks numerous financial advantages and legal protections. Being a filer enhances one’s financial standing and facilitates smoother transactions across various sectors, ultimately promoting economic growth.

The Advantages of Being a Filer

Achieving and maintaining filer status in Pakistan is synonymous with unlocking a plethora of financial benefits and reducing tax liabilities. Below are some of the key advantages associated with being a filer:

1. Reduced Tax on Property Purchases

Filers benefit from a significantly lower tax rate of 1% on the purchase of immovable property, such as houses, flats, or plots. In contrast, non-filers face a 2% tax rate, effectively doubling the financial burden on real estate investments. This advantage makes property ownership more accessible for compliant taxpayers.

2. Lower Tax on Prize Winnings

Individuals listed on the ATL are taxed at 15% on prize bond winnings, while non-filers endure a 30% tax rate. This disparity dramatically reduces the net earnings for non-filers, making it more financially beneficial to file tax returns.

3. Tax Relief on Bank Profits

Filers enjoy a reduced tax rate of 15% on profits or yields from bank savings and profit-bearing accounts. Conversely, non-filers face a 30% tax on the same income, resulting in significantly lower financial returns for those who do not comply with tax regulations.

4. Vehicle Registration and Token Tax Discounts

Filers receive a 50% concession on vehicle registration and annual token taxes compared to the amounts payable by non-filers. This incentive considerably lowers the cost of vehicle ownership for compliant taxpayers.

5. Lower Taxes on Commercial Imports

When importing raw materials or other commercial goods, filers are subject to a 6% tax at customs clearance, while non-filers are taxed at 12%. This difference provides filers with a competitive advantage in business operations, allowing them to allocate more resources toward growth and development.

6. Reduced Tax on Dividend Income

Dividend income is taxed at 15% for filers, compared to a hefty 30% for non-filers. This tax relief encourages investments in the stock market and mutual funds, fostering a more robust investment culture among compliant taxpayers.

7. Savings on Auction Sales

Filers benefit from a 10% tax on auction sales, while non-filers are taxed at 20%. This significant difference incentivizes filers to actively participate in auction-based transactions, enhancing their economic engagement.

8. Lower Taxes on Goods and Services

In terms of commercial supply, filers are taxed at a reduced rate of 4.5% on goods, whereas non-filers face a 9% tax. For services, filers encounter a 10% withholding tax, while non-filers are taxed at 20%. These lower rates promote business activities among compliant taxpayers.

9. Reduced Tax on Execution of Contracts

Filers enjoy a significantly lower tax rate of 7.5% on the execution of contracts, compared to 15% for non-filers. This reduction translates into substantial savings for individuals and businesses engaged in contractual work, making compliance more appealing.

10. Tax Relief on Commissions

Commission income is taxed at 12% for filers, while non-filers face a 24% tax rate. This substantial difference results in considerable financial savings for compliant earners, further incentivizing tax compliance.

Who is a Non-Filer in Pakistan?

A non-filer is an individual or entity that does not file income tax returns and is not listed on the FBR’s ATL. This non-compliance leads to various financial and legal disadvantages, including higher tax rates and restricted access to economic opportunities.

Consequences of Being a Non-Filer

The repercussions of remaining a non-filer can be severe and multifaceted. Here are some of the critical consequences:

1. Higher Withholding Taxes

Non-filers are subjected to significantly higher withholding tax rates on transactions, such as property purchases, banking profits, and vehicle registrations. This financial burden can deter individuals and businesses from engaging in various economic activities.

2. Restricted Access to Financial Services

Non-filers often encounter difficulties in securing loans, leasing vehicles, or obtaining mortgages, as financial institutions prioritize filers for such services. This limitation can stifle personal and business growth.

3. Legal Penalties and Fines

Failure to comply with tax regulations can result in fines, penalties, and legal action from the FBR. Such consequences can exacerbate the financial strain on non-filers, making it even more challenging to achieve financial stability.

4. Limited Participation in Economic Opportunities

Non-filers are frequently ineligible for government tenders, contracts, and other public sector opportunities. This exclusion limits their potential for economic growth and advancement.

How to Become a Filer in Pakistan?

Transitioning from a non-filer to a filer is a straightforward process that begins with registering with the FBR. Here are the essential steps to achieve filer status:

- Obtain an NTN (National Tax Number): Register with the FBR through their online portal or consult a tax professional to receive your NTN.

- Submit Income Tax Returns: File your income tax returns annually, detailing your income, expenses, and applicable deductions.

- Check the Active Taxpayers List (ATL): Confirm that your name appears on the FBR’s ATL to verify your filer status.

- Maintain Compliance: Continue filing tax returns each year to retain your status as a filer and enjoy uninterrupted benefits.

Major Differences Between Filers and Non-Filers

Table

Aspect | Filer | Non-Filer |

Tax Compliance | Regularly files income tax returns | Does not file tax returns |

Withholding Tax Rates | Lower rates | Higher rates |

Access to Financial Services | Easy access to loans and mortgages | Restricted access |

Participation in Tenders | Eligible | Often ineligible |

Legal Standing | Compliant with tax laws | Non-compliant |

The Legal Implications of Non-Filing Income Tax Returns in Pakistan

Failing to file an income tax return in Pakistan is not merely an oversight or irregularity; it is considered an offense under the law that carries significant penalties. The legal framework established by the Income Tax Ordinance, 2001, emphasizes the importance of timely tax filing, delineating the consequences for non-compliance.

Understanding the Offense of Non-Filing

Under Section 114 of the Income Tax Ordinance, any individual or entity required to submit an income tax return must do so by the specified due date. Ignoring this obligation is deemed an offense that can lead to financial repercussions. The law is clear:

- If a person fails to file their return on time, they are liable to pay a penalty equivalent to 0.1% of the tax payable for each day the return remains outstanding.

- However, this penalty is capped at a maximum of 50% of the total tax payable for that tax year.

- It’s important to note that if the calculated penalty is less than PKR 40,000, or if no tax is payable for that particular year, the individual will still incur a penalty of PKR 40,000.

- For individuals whose income primarily comes from salaries (specifically 75% or more), if the total salary income is less than PKR 5 million, the minimum penalty is reduced to PKR 5,000.

- Provisions under Section 118 reinforce these penalties, categorizing non-filing as a serious offense and further stressing the importance of compliance.

The Importance of Compliance

The law’s strictures regarding tax filing aim not only to encourage compliance but also to ensure that all individuals contribute their fair share to the national revenue. This mechanism is crucial for the government to fund public services and infrastructure projects, ensuring the economic stability and development of the country.

The Consequences of Non-Compliance: Why Filing Tax Returns is Crucial?

By failing to file their returns, non-filers expose themselves to hefty penalties and financial burdens that can impede their ability to engage in various financial transactions, apply for loans, or participate in government contracts. Additionally, repeated non-compliance can lead to more severe legal actions and complications, making it imperative for individuals and entities to recognize their tax obligations and fulfill them promptly.

Non-Filing of Income Tax Returns in Pakistan is a Legal Offense

In summary, non-filing of income tax returns in Pakistan is a legal offense that comes with serious implications, including financial penalties that can escalate quickly. Understanding the legal obligations outlined in the Income Tax Ordinance, particularly Sections 114 and 118, is essential for every taxpayer. By filing their returns on time, individuals not only avoid punitive measures but also contribute positively to the economic framework of the nation, reinforcing their role as responsible citizens.